Extraordinary Transactions: How to Assess Tax Risks Before an Acquisition

Tax due diligence for SMEs. Key checks, potential liabilities and clauses that protect price.

Acquisitions in the SME space are often fast and business driven. Without a solid tax due diligence, buyers may also purchase hidden liabilities that surface after closing. A technical review done before signing protects both price and continuity.

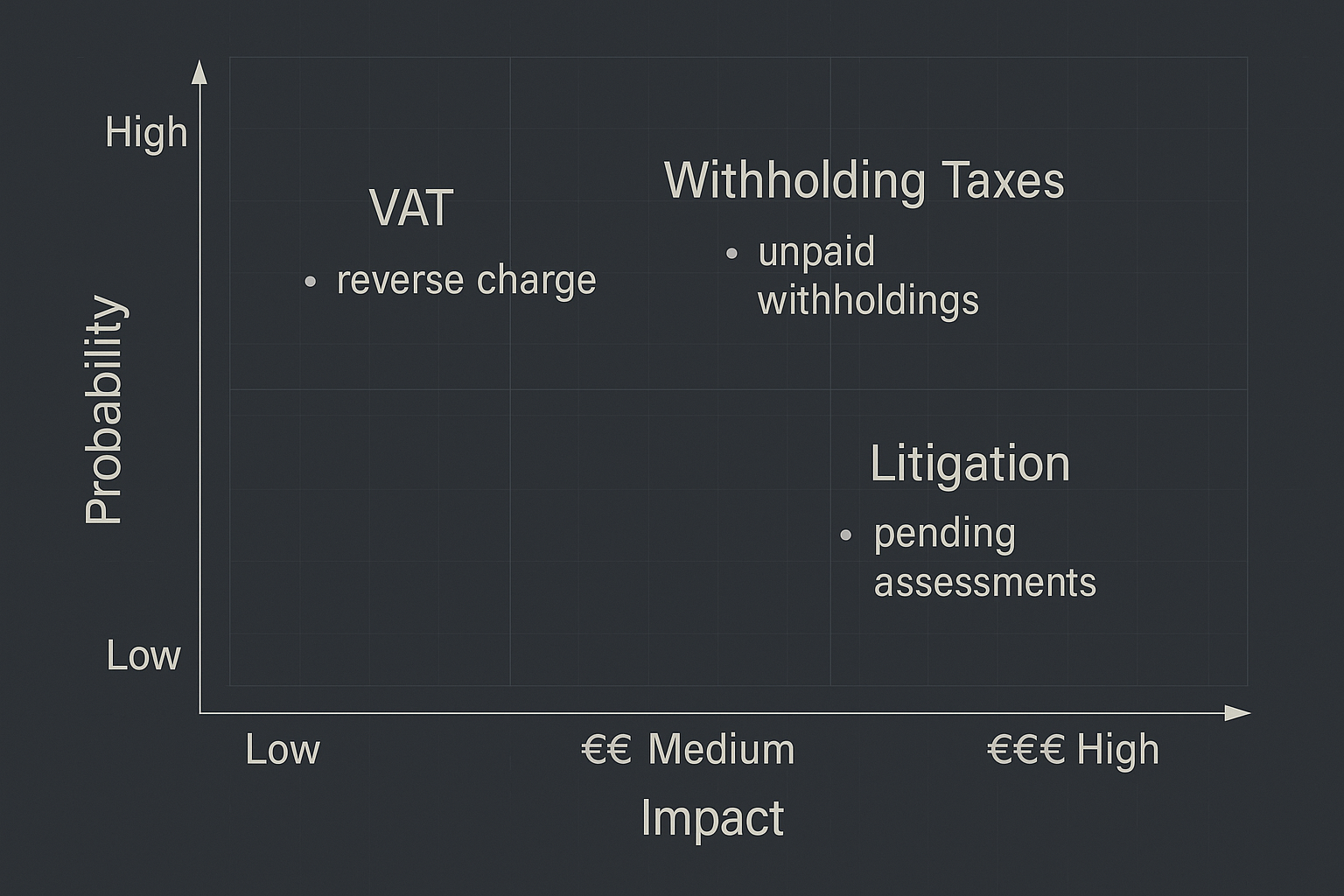

Where tax risks arise

- VAT and withholdings: undocumented transactions, reverse charge mistakes, unpaid withholdings.

- Direct taxes: unsupported deductions, loss carryforwards that cannot be used.

- Tax credits: irregular use or credits that are not legally due.

- Intragroup transactions: missing transfer pricing documentation.

- Cross-border reporting and permanent establishment: foreign presence not monitored.

- Litigation: ongoing assessments and potential penalties.

Share deal or asset deal

- Share deal: Past risks are acquired with the shares. Buyers need warranties and price adjustments.

- Asset deal: Buyers pick assets or business units. Watch capital gains, VAT and indirect taxes.

How to structure the tax due diligence

- Scoping: Tax perimeter, fiscal years to cover, foreign entities and branches.

- Documents: Tax returns, payment proofs, contracts, transfer pricing file, rulings and positions.

- Testing: Samples on VAT, withholdings, expenses, credits and losses.

- Evaluation: Risk matrix with likelihood and estimated financial impact.

- Output: Short decision-ready report for negotiations.

Clauses that protect the buyer

- Representations and warranties on the tax position.

- Indemnities tailored to specific findings.

- Escrow or holdback to cover potential exposures.

- Post-closing covenants and timely information duties.

Short case study

The target holds tax credits worth 500k that are only partly supported. The due diligence rates a medium risk. The SPA includes a dedicated indemnity and a price adjustment conditional on the tax authority’s confirmation.

How D-Audit can support you

We run a focused tax due diligence that targets what moves the price. You receive a clear risk matrix and practical economic clauses to manage exposures, working alongside your legal and financial advisors.